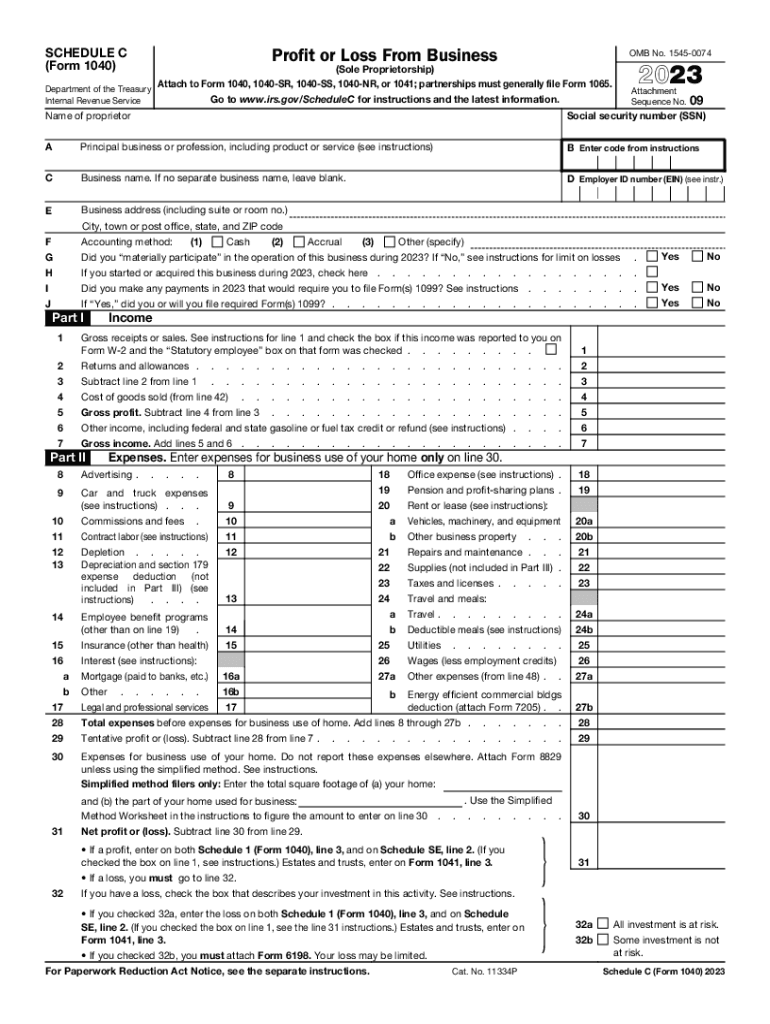

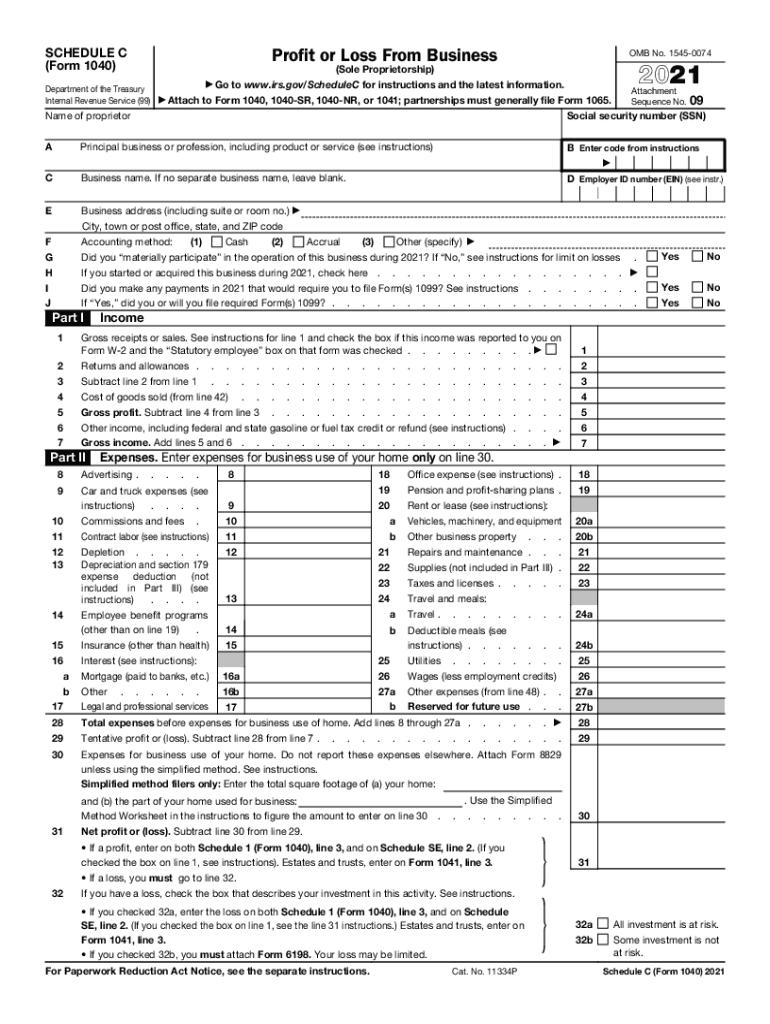

2024 Form 1040 Schedule C Form – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . You take the deduction on Schedule C if you are self-employed or a sole proprietor, or as an itemized deduction on Form 1040 if you are an employee. Business-related meal expenses for employees .

2024 Form 1040 Schedule C Form

Source : www.kxan.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comSchedule C (Form 1040) 2023 Instructions

Source : lili.coIRS Schedule C (1040 form) | pdfFiller

Source : www.pdffiller.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.org1040 schedule c: Fill out & sign online | DocHub

Source : www.dochub.com2024 Form 1040 Schedule C Form Harbor Financial Announces IRS Tax Form 1040 Schedule C : Travel expenses can be deducted on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss From Farming, if you’re self-employed or a . Are there ways to reduce this tax burden? Here’s what you need to know. Schedule C (1040) is an IRS tax form for reporting business-related income and expenses. Its official name is Profit or Loss .

]]>