2024 Irs Schedule C – If you want to avoid an audit this year (or any year), check out these common tax mistakes that could land you in hot water. . Digital assets are also raising red flags with the agency, advisors say. “Auditors will take on analyzing taxpayers’ cryptocurrency transactions to ensure proper reporting related to acquisition, .

2024 Irs Schedule C

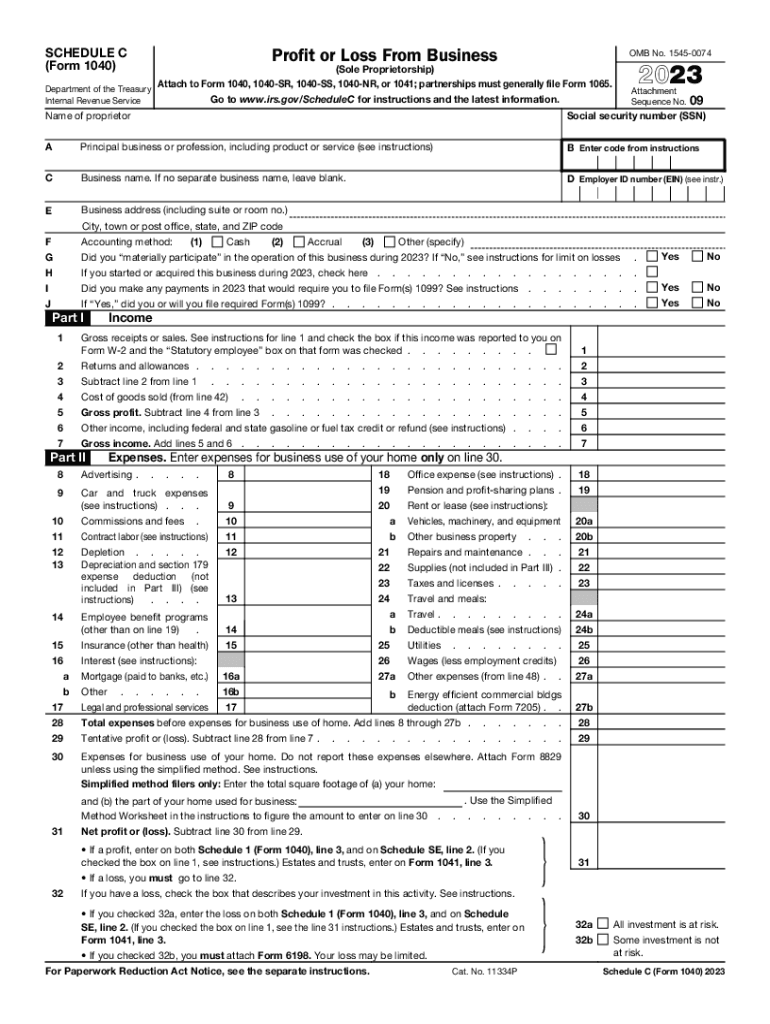

Source : www.kxan.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

IRS Schedule C (1040 form) | pdfFiller

Source : www.pdffiller.comHow To Claim Mileage From The IRS Step By Step | Updated For 2024

Source : www.driversnote.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.com2023 Instructions for Schedule C

Source : www.irs.govbasics – Money Instructor

Source : content.moneyinstructor.com2024 Irs Schedule C Harbor Financial Announces IRS Tax Form 1040 Schedule C : It takes about nine hours for most people to do their taxes—more than enough time to mess something up.Filing errors come in many forms. Taxpayers can forget to report interest, or make a math mistake . Schedule c, Profit or Loss from Business (Sole Proprietorship). You will need to review the forms, determine if the amount is correct, and determine any deductible expense using your tax records when .

]]>