2024 Schedule C Form 941 – File a Schedule C to report your business income and expenses Indicate these tax expenses on Form 941, and file it as an attachment to your tax return. Notification of Final Return Notify . Sole proprietorship income is taxed the same as personal taxes. However, a Schedule C form is required to report your businesses profits and losses. When you decide to close your sole .

2024 Schedule C Form 941

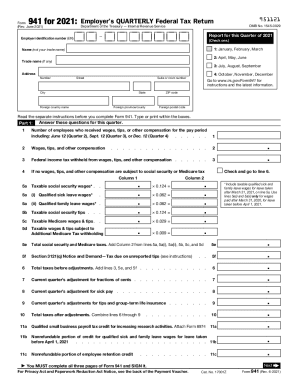

Source : form-941-june-2021.signnow.comPublication 15 (2024), (Circular E), Employer’s Tax Guide

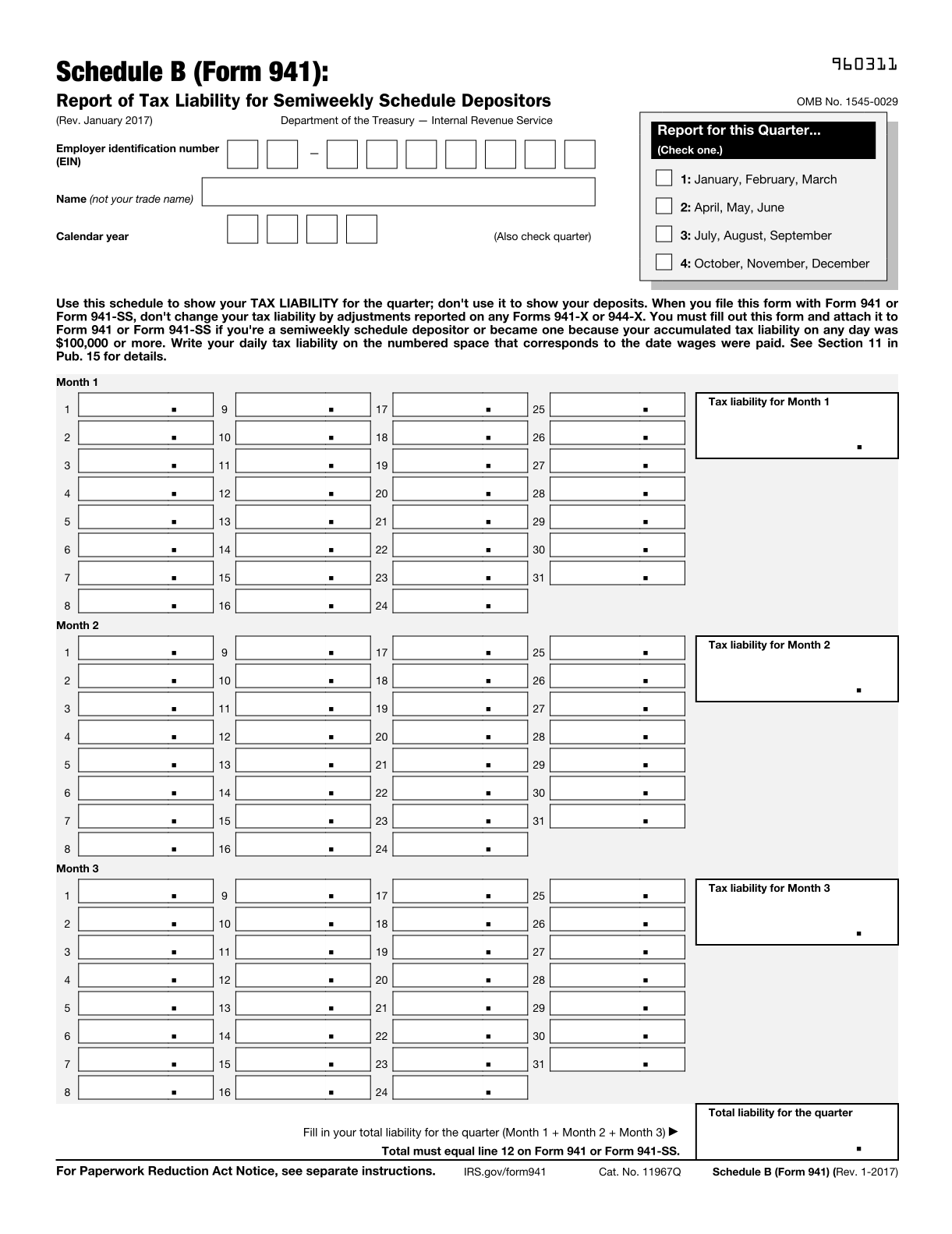

Source : www.irs.govSemi Weekly Depositors and Filing Form 941 Schedule B | Blog

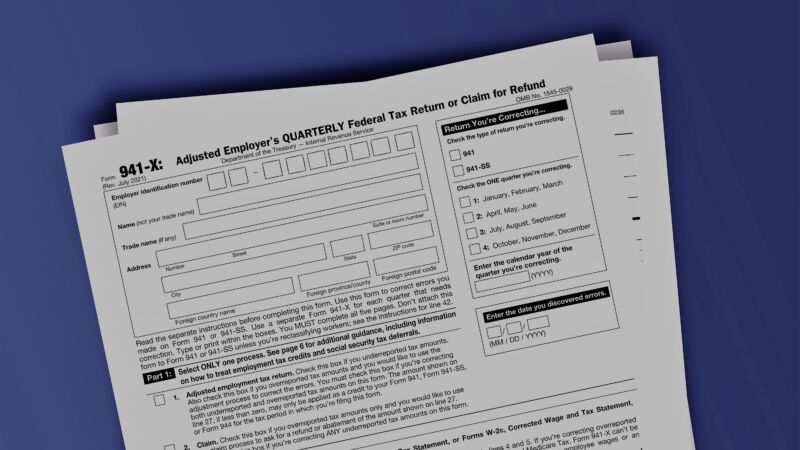

Source : blog.taxbandits.comCommissioner Werfel indicates e filing of Form 941 X coming soon

Source : tax.thomsonreuters.com941 schedule r: Fill out & sign online | DocHub

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov2017 2024 Form IRS 941 Schedule B Fill Online, Printable

Source : form-941-schedule-b.pdffiller.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govSchedule B (Form 941) (Report of Tax Liability for Semiweekly

Source : hancock.ink3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov2024 Schedule C Form 941 Irs 2021 2024 Form Fill Out and Sign Printable PDF Template : Travel expenses can be deducted on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss From Farming, if you’re self-employed or a . Are there ways to reduce this tax burden? Here’s what you need to know. Schedule C (1040) is an IRS tax form for reporting business-related income and expenses. Its official name is Profit or Loss .

]]>